Comprehensive wealth management

The foundation of our operations is independent manager selection and wide access to all asset classes. We always invest through the most efficient instruments and do not use our own products in the public market. Our manager selection process is independent, systematic, in-depth, and neutral across various instruments. If we suggest an active and higher-cost asset for the portfolio, it is backed by strong insights and analysis.

Team

The CapMan Wealth team consists of experienced investment professionals whose strengths create an efficient and dynamic organization. Our team meets with approximately 200 portfolio managers annually, acting as a professional “buyer” by challenging traditional sales pitches and focusing on genuine value creation.

True independence

Customer-centricity and independence are at the heart of our operations. We do not sell investment products where our short-term interests conflict with the client’s long-term goals. Additionally, we do not accept kickbacks from any investment funds we select, regardless of the asset class.

Private market expertise

Our operations are supported by CapMan Group’s extensive expertise in private equity and real assets within the Nordic market. We also conduct active manager selection in the private market globally, with a focus on private equity, private credit, and infrastructure.

We are never fully satisfied with our manager selections and always strive to find the most interesting and better opportunities for our portfolios based on our insights

Mikael Löfberg, Chief Investment Officer

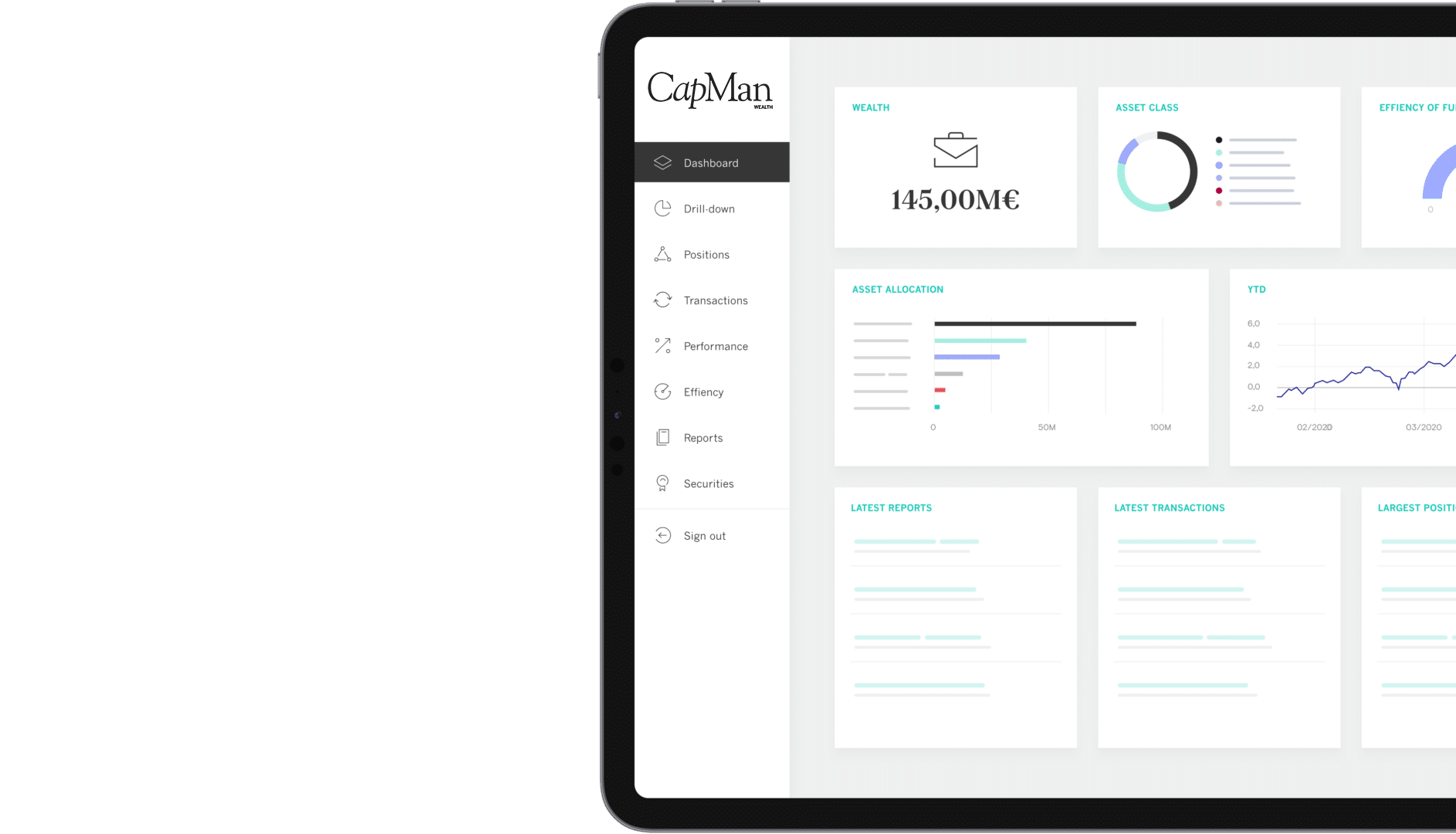

Reporting

As our client, you will have access to a reporting portal where all investment information is compiled in one place. Investments, such as funds, are broken down into underlying positions, making it easier to identify overlaps.